What is seed capital? Finance your business!

Probably, more than once we have found ourselves thinking about an interesting business idea that we want to put into action.

However, we are discouraged by the reality that if we don’t have enough money to produce our prototype product or service, we can’t get started.

Likewise, you may think that a bank loan is the solution. However, their financial interests and requirements may discourage you.

But what if I told you that there is a way you can start your business model without demonstrating an amazing sales track record?

Let’s see what seed capital is all about, a start-up financing option that gives you great benefits without so much risk.

What is seed capital?

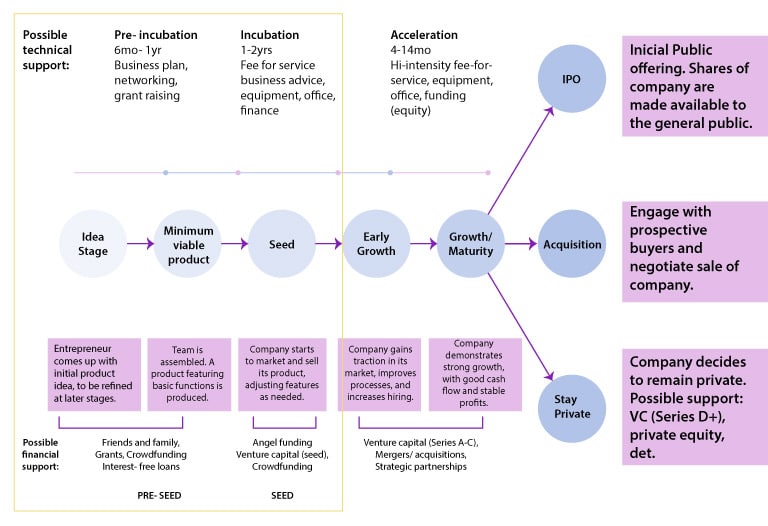

Seed capital, also called seed financing, is a type of financing for new initiatives in which, in exchange for a part of the business, an investor provides you with the money you need.

Consequently, it is an early investment that focuses on supporting the creation of a company because of the history of its creators or its potential growth opportunity.

This is, of course, the opposite of a venture capital fund, in which a smaller number of companies are backed by looking at their ability to generate an adequate turnover of income and expenses (cash flow).

What is it usually used for?

According to the business activity of the company, seed capital can be invested for:

- To elaborate prototypes.

- Marketing and advertising campaigns.

- Market research.

- Protection of the idea (intellectual property or copyright).

- Purchase of elements necessary for the operation of the company.

What type of companies can benefit?

Any type of company or natural persons that are starting up and present an innovative idea in the local, national or international market that allows:

- Address new market niches, that is, consumer groups that have not been taken into account so far by any business idea.

- Develop an interesting and new technology.

Among these ventures, we can find, for example, startups or emerging companies that present striking ideas related to technology.

Who can be investors?

In seed capital, we can receive investments from three parties:

- Financing from family, friends or the founders themselves through their savings.

- Angel investors.

- Crowdfunding or collective financing. If you want to know a little more about this type of investment, you can find it in our article on the subject.

What do you say? Are you ready to put your revolutionary idea into action?

If you want to learn more about these topics, remember that at Bitsa blog we bring you the best weekly content on finance, marketing, investments and other topics from the best writers, and we’ll see you in a future article!