What is decentralized finance (DeFi)?

You may have heard that the technology that makes bitcoin possible, rather than its price, is what gives it its true power. Decentralized finance is another example of how powerful blockchain, the technology that enables bitcoin, can be.

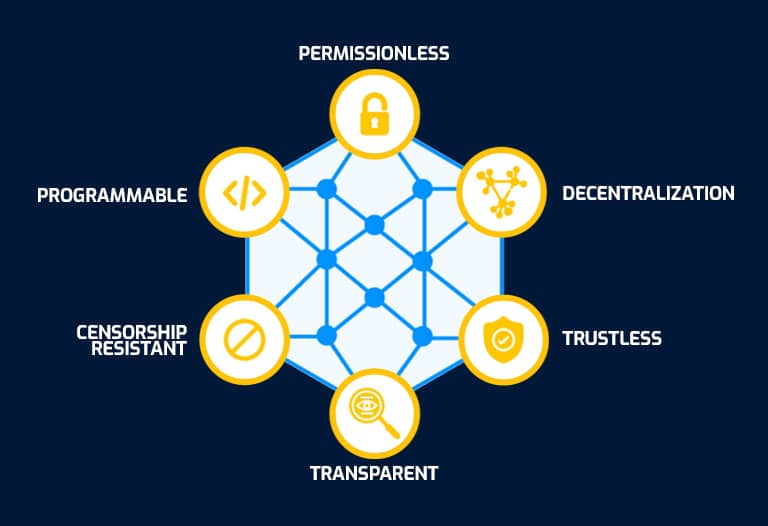

Permissionless is one of the primary advantages that blockchains offer. We were suddenly faced with a world of possibilities where no permission was required to utilize or even to create decentralized applications. DeFi was born as a result of the limitless possibilities.

This freedom has two sides, though. The good thing is that everyone is welcome to participate in the creation of this new global economic order. The unpleasant aspect is that malicious actors have their own space as well.

What does decentralized finance mean?

Decentralized finance, or its acronym DeFi, is a set of applications that, in the beginning, replicate the traditional financial sector but in a decentralized and permissionless way. Those characteristics, the ones that differentiate DeFi from the centralized finances, CeFi, are given by the technology underlying DeFi, the blockchain.

DeFi lets everyone use their cryptocurrencies to access most services that traditional banks offer, like:

- Lending

- Borrowing

- Earning interest

- Trading assets

- Buy insurance

However, as there are no regulations in DeFi there are also no limits. So, sooner rather than later, we had the opportunity to see the emergence of new and innovative products. Just to name a few:

- Yield farming

- Liquidity mining

- Incentivized pools

- NFT staking

DeFi has achieved to cut out the middleman and made financial interactions quicker, cheaper, and more efficient.

But before we go any further, let us understand how it has been possible to get to the point where we are talking about a complete ecosystem of decentralized finance.

How was decentralized finance born?

Before Ethereum, blockchains were used to make pear-to-pear transactions, without the need of a trusted third party. Although it was already a big revolution a young guy proposed a change in the Bitcoin programming language to enable the development of decentralized applications that would be built on top of that blockchain. The Bitcoin community said no, and that guy with a bunch of other enthusiastic OG started working on their own network.

If you haven’t guessed, that guy’s name is Vitalik Buterin and the new blockchain was Ethereum. Smart Contracts made a whole revolution in the crypto space. They let people develop their own ideas a deploy them as decentralized platforms on the Ethereum network.

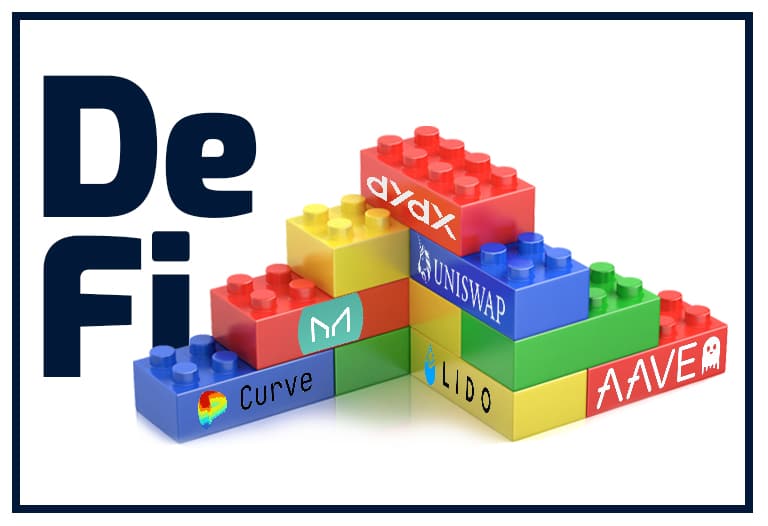

In the beginning, developments like Bancor, Uniswap, or MakerDAO started to populate the blockchain while people were trying to understand what was going on there. After a while, new devs start building on top of what others have done before and the money legos began to unleash their power.

Imagine this scenario. MakerDAO says if you deposit your ETH here, you can mint DAI and have an 8% APR. Then a new platform says, bring those DAIs and have a 6% APR. But also, you can take a loan of USDC and just pay 3% a year. And so the wheel could go round and round endlessly. Those were the early days of DeFi, money legos, and the whole revolution that ended up triggering the DeFi summer and having more than 95 billion total value locked on the DeFi ecosystem at its peak.

After that summer, multiple layer one blockchains were created and DeFi applications starts spreading beyond the limits of Ethereum. Nonetheless, the distance between Ethereum total value locked and the rest of the ecosystem is still quite big.

How DeFi work?

The main creation that allowed the born of a decentralized finance ecosystem was Smart Contracts. They replaced trusted third parties and remove them as a necessary part to enable people’s trust. Users are sure that a decentralized application will act accordingly to what is written on that Smart Contract and that’s the key reason why they trust and deposit their capital in them.

Now, let’s explore this fantastic piece of innovation in depth.

What is a Smart Contract?

Smart contracts are just software developments designed to be self-executing contracts on a blockchain. The most important thing about them is that they run automatically when the previously established conditions are met. The reality is that they tend to be as “simple” as statements like “when this happens this will be the output”.

A good example of a Smart Contract would be, a piece of code that when it receives a cryptocurrency deposit will return a reward according to the total deposited amount in the contract. Previsibility, permissionless and innovative solutions seem to be what Smart Contracts can provide to a decentralized economy.

Current uses of decentralized finance

The DeFi ecosystem is one of the most restless and intense in the crypto-space. New ideas are coming up every day. It’s quite easy to encounter borrowing and lending platforms. But we can also have applications for savings, earn interest on crypto, trading, fund management, and insurance. Let’s see some examples.

Stablecoins

As we said when we talk about them last week, stablecoins generated an enormous impact by eliminating the high volatility that other cryptocurrencies have. However, they didn’t just attract a huge number of users, that used to be afraid of highly volatile assets, they also started the DeFi revolution when DAI was created.

MakerDAO, the decentralized organization that brought DAI into being is considered to be the father of DeFi. In short, they enable deposits of ETH to mint a stablecoin, DAI, which is pegged to the American dollar. In the meantime, the depositor gains an 8% APR and it’s free to utilize those DAI on other platforms. After doing their business, the depositor can return or burnt those DAIs in order to recover the ETH firstly deposited.

This magnificent proposition was replicated tirelessly while DeFi opportunities continue to arise. Nowadays, we can guarantee, that without stablecoins DeFi wouldn’t be possible.

DeFi lending and borrowing

Certainly, they were the first major DeFi application on Ethereum. Lending platforms allow users to lend digital assets to others while earning interest. On the other hand, borrowers have to deposit cryptos in guarantee for the loans that they take. They basically work as normal lending and borrowing platforms, but with all their fund management and operations executed automatically by smart contracts.

Decentralized exchanges

Also known as DEXs, they play a big role in the DeFi revolution. Every economic movement needs liquidity. As obvious as it seems, it’s not easy to gather liquidity without a central entity in charge to provide it or at least to raise the necessary amount of money needed to put a system on track.

However, Bancor at the beginning, and then Uniswap took an exceptional model for attracting liquidity to the market. Is called AMM or automated market maker. In this model, we have pools of two tokens, created by smart contracts that are always aware to have the same amount, in USD dollars, of the two coins that form the pool. Those pools are open to anyone and when a trade is made and the pool gets unbalanced, automatically the pool would offer one of the coins at a lower price to regain the balance.

Of course, those who provide liquidity gain a percentage of the fees charged to traders and, some protocols, offer rewards on their own tokens. This is where we meet the power of Smart Contracts and DeFi.

The risks of decentralized finance

While DeFi is an amazing movement, powered by innovation, inclusion, and opportunities for all, there are risks worth mentioning. The first one, due to the permissionless that characterize this movement also unavoidable is the high amount of scam that we have in DeFi. As I say at the beginning, the fact that there is no need to ask for permission, let malicious actors to deploy their own Smart Contracts and scam people. That’s why we have to be extremely cautious while using DeFi platforms.

Another great risks that we encountered in this ecosystem are Smart Contracts hacks. The problem with DeFi is that every mistake costs huge amounts of money. Unfortunately usually are final users who paid those expenses. As we know, we are just beginning to explore what these new technologies are able to perform and more hacks or bugs exploitation are expected until we ended up with a more robust and secure environment.

The future of DeFi

If we look back and do some maths, Ethereum has just seven years. The DeFi ecosystem is even younger. To give some context, the DeFi summer took place on 2020. This movement is barely starting.

Whereas, the numbers are quite incredible. 95 billion dollars of total value locked at its peak, sounds not a negligible number. Despite being in the early days, the level of innovation at times looks like something out of a science fiction fairy tale.

Even though it goes again the ethos of the whole decentralized movement, traditional institutions are validating the DeFi ecosystem by using their platforms. In that sense, recently the Huntingdon Valley Bank took a loan on DAI.

Beyond the need to separate from traditional finance, this news serves to validate the real usefulness of all that DeFi has created. The spark has been ignited. Once crypto becomes widely adopted, there will be no turning back.