The best books on personal finance

When you begin to receive a regular income, needs begin to appear about your personal finances, But when we hear the word “finance” we usually associate it with investments, economy, stock market, mathematics, among other things that we might consider complicated. However, finances influence everything, even our daily lives.

Personal finances refer to the management and administration of money and assets of an individual or family. In other words, the management of all your money: income, expenses, material goods, savings funds, investment funds, credits, insurance, etc..

Knowing what personal finances are and knowing how to handle it can be a great challenge for some people, but it is a indispensable topic for the good and correct handling of personal money. This encourages us to be aware of every decision we make when using our money, as these decisions can benefit or harm our quality of life and our future. Using our money wisely can create long-term wealth that will help us have a better quality of life.

The 3 best books on personal finance

In order to start successful financial planning, we recommend you the following books:

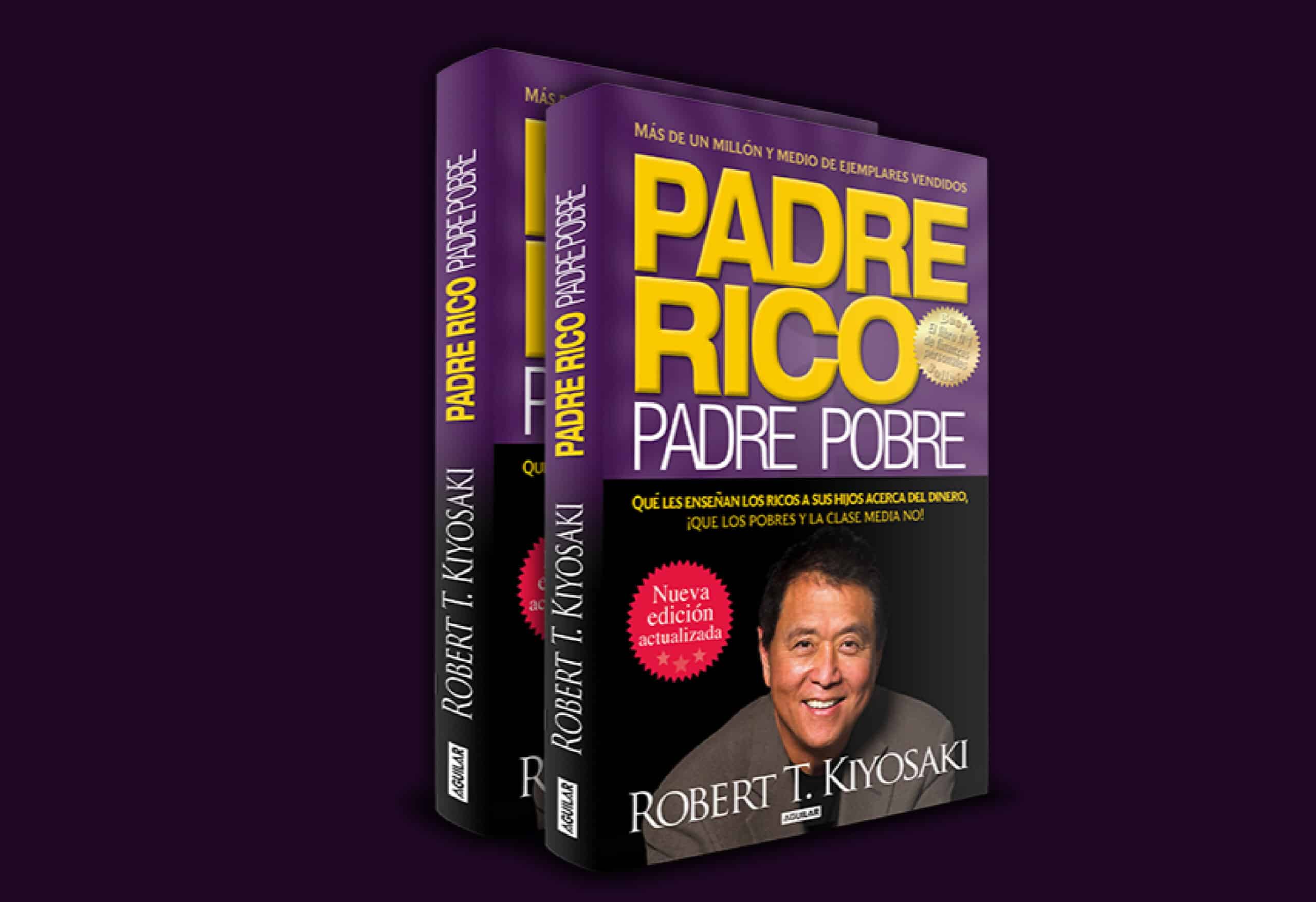

- Rich Dad, Poor Dad. Robert T. Kiyosaki

This book explains how during school we are not taught to earn and manage money, ensuring that this skill is learned during practice.

Among his main learnings, he talks about the , asegurando que estos nos brindarán muchas más riquezas en el futuro que cualquier trabajo; la importancia de tomar riesgos financieros con el fin de hacer crecer las riquezas; trabajar para aprender y no para ganar dinero; crear oportunidades y no esperarlas; la importancia de entender los impuestos y la ley, entre otras.

- Little Capitalist Pig. Sofía Macías

Based on the prejudices caused by “having money”, Sofía Macías starts a blog about the importance of financial education.

Therefore, through a simple language, it seeks to give information to its readers to understand, in a simple way, the important topics to start a financial education. Among these, he talks about the savings, goals, expenses and budgets, funds for emergencies, how to use credits in your favor, how to start an investment, retirements, insurance, among other things.

- Money Master The Game. Tony Robbins

Many people are intimidated by investments and finances, and that fear can prevent them from achieving financial stability. This book tells us about the principles necessary to obtain a healthy financial education and initiate simple investments to obtain future wealth.

In short, financial education is a subject that we will not be taught in school, and therefore it is a subject that many people fear. However, not risking knowing and handling these issues, can lead us to a life without financial stability and peace of mind.

Remember that much of this learning is obtained with practice and is learned from mistakes. To minimize the latter, reading the aforementioned books can serve as guidance to start our financial planning.

SIf, on the other hand, you are not passionate about reading or you really do not have time to read any of these books, we understand you. That is why we recommend that you at least start by taking care of your personal finances with a card like Bitsa that you can recharge with the amount you want and, in this way, set a limit so as not to exceed yourself with unnecessary expenses.