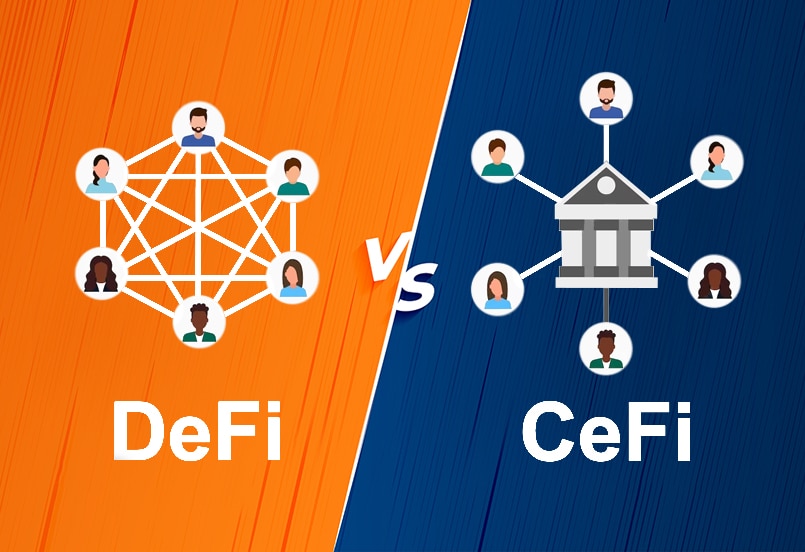

Centralization vs Decentralization

The number of consequences that the crypto world has unleashed in our society will be a source of analysis for future historians. Beyond the revolution from a technological and financial point of view, the daily discussion has been enriched, even leading us to contrast Centralization vs Decentralization.

In the past, these concepts, which clearly go beyond the cryptocurrency ecosystem, were not discussed as often as they are today. Models of such scale need to be disseminated and known, in order to take advantage of their benefits in all possible situations.

Today it is our turn to analyze two contrasting ways of organization, to learn about their advantages and disadvantages, and of course to extract the best from each standard. Without taking off our “crypto-glasses”, let us analyze centralization and decentralization.

Centralization and decentralization, an overview

Centralization and decentralization are two opposing systems or approaches that can be applied to a variety of fields, including

- Economics

- Politics

- And, of course, Technology

A centralized system is one in which the power, that comes hand in hand with control, is concentrated in the hands of a single authority or a small group of authorities. In a centralized system, decision-making and resource distribution are centrally controlled, and there is little or even no room for local autonomy or independence.

Decentralization, on the other hand, refers to a system where power or control is decentralized or dispersed among several authorities or entities. Evidently, in a system based on decentralization, resource distribution and also decision-making are better distributed. Additionally, there is greater room for local independence and autonomy.

Both centralization and decentralization have benefits and drawbacks. The best approach will rely on the particular circumstances and objectives of the system in question.

Centralization from a crypto perspective

Seeing from a cryptocurrency optic, centralization refers to the degree to which control over a particular aspect of the network or currency is concentrated in the hands of a single entity or small group of entities.

When we talk about centralization in the crypto world, the first thing that comes to mind is exchanges. They work in a very simple way, and centralization comes to the surface quite soon. In exchanges, there is one individual, several or perhaps a group of investors, who provide the necessary money, known as liquidity.

With this liquidity, a certain amount of cryptocurrencies are acquired, which are stored in wallets owned by the exchange. Within the platform, users operate with representations of those cryptocurrencies that the exchange claims to hold.

Once a user withdraws their crypto from the platform, the exchange sends part of those cryptocurrencies originally acquired to the requested address. Perhaps now, it is simple to understand the phrase, not your keys not your coins. Until the cryptocurrencies have been withdrawn from the exchange, the exchange continues to own them.

However, there are several ways in which we can find that a cryptocurrency o a blockchain can be centralized, such as:

- Mining

- Development

- Ownership

Let’s these cases in detail.

Mining Centralization

Mining Centralization occurs when a small group of miners control a large portion of the network’s mining power, at least more than 50%, allowing them to have disproportionate influence over the network’s consensus process. In a decentralized network, mining power should be distributed among a large number of independent miners. With decentralization, we know that no single miner or group of them dominate the network.

Development Centralization

We found Development Centralization when the degree to which a single entity or small group of entities controls the development of the cryptocurrency’s software is high. A centralized development process may mean that changes to the software are made without a wider community. It also occurs when the development process isn’t transparent. Of course, in a decentralized system, development must be an open and collaborative process.

Ownership Centralization

This kind of centralization occurs when a small group of individuals or entities own a large proportion of the total supply of a cryptocurrency. The great risk here is the manipulation of the currency’s price and its use. Centralization can also happen in a more broad sense when a coin is heavily influenced by a single exchange or a country, which makes the network or coin more vulnerable to government intervention or market manipulation.

The hard reality

A fact that we need to face is that most cryptocurrencies have a degree of centralization. Bitcoin is considered the most decentralized one compared to other major coins like Ethereum. Certainly, It’s important to understand the degree of centralization that a cryptocurrency has. A high degree of centralization can affect its resilience to censorship and its long-term stability.

Centralization has brought us to the point where decentralization has become extremely necessary.

Advantages of centralization

Although it isn’t looked upon with much appreciation in the crypto world, centralization has its benefits. We will go through them below.

Scalability

Centralized systems can scale easily. This occurs because the workload can be distributed among a smaller number of servers, rather than having to be spread across thousands or even millions of nodes in a decentralized network.

Faster decision-making

With centralized control, decisions can be made more quickly and efficiently. Obviously, there is less need to reach a consensus among a large number of participants, so decisions are taken faster.

Adaptability to regulation

Governments and other regulatory institutions may find it easier to oversee and control centralized cryptocurrencies. The main advantage is that having a clear entity responsible for the currency’s operations, they know who is responsible in case of non-compliance.

As we can imagine, centralization in cryptocurrencies can bring certain benefits, but also disadvantages. Now, it’s our turn to focus on the latter.

Disadvantages of centralization

After reviewing the benefits of centralization, we come to the moment every decentralization fanatic has been waiting for. Let’s review the disadvantages of centralization.

The single point of failure

Centralized systems are more vulnerable to attacks because a single point of failure can bring down the entire system. Furthermore, centralized exchanges have a history of hacking.

Lack of decentralization

The title may seem obvious, but we should dedicate a paragraph to it. One of the main arguments for cryptocurrencies is the decentralization of their network. Thanks to this, they are censorship-resistant, transparent and robust. When a network becomes centralized, it loses these characteristics and many users may lose trust and may stop using it.

Lack of innovation

A centralized network stifles innovation because the actors in control are less likely to want to change the status quo. This lack of innovation can make the network less useful over time.

Users inequality

Centralized networks tend to benefit the actors in control while leaving others at a disadvantage. This can lead to increased economic inequality and a concentration of wealth among a small group of users.

Beyond its advantages and disadvantages, it’s important to consider when the potential benefits of centralization will be beneficial to a project. If sufficient justification can be found, it is possible to opt for this path.

Blockchain technology, and cryptocurrencies, have taken decentralisation to the centre of the global discussion.

The crypto world and the rise of decentralization

By using our cryptocurrency glasses, we can say that decentralization means having distributed control over a blockchain, a platform or even a cryptocurrency, among a large number of actors. It’s possible to point out that the primary goal of decentralization is to ensure that no single entity or group of entities has too much control over a crypto-project. After achieving this primary goal, a decentralized network would give as many people as possible an equal say in how the project should be run.

Now, let’s see what are the main characteristic of a decentralized blockchain.

A decentralized ledger

When we define a blockchain, this is one of the first concepts that come to mind. It is the record of all transactions that have taken place on the network. This record is kept by the nodes. As the ledger is distributed over many computers, there is no single point of failure, which makes the network more robust and resistant to attacks.

A network of nodes

Playing an extremely important role, we can define them as those who communicate with each other in the different actors in a blockchain. They are the computers that run the software that powers the network and are responsible for validating transactions and maintaining the ledger. It’s worth mentioning that the nodes can be managed by any user who is willing to make the necessary effort. They are undoubtedly the foundation of decentralization.

A consensus mechanism

When we use a blockchain, we trust that the information we receive is accurate. Have you ever wondered what guarantee there is? Well, the guarantee comes from knowing that the actors in the ecosystem will comply with the consensus mechanism. These mechanisms make it possible for the network to agree on the state of the ledger. By respecting this mechanism, networks are secure and attack-resistant. The most famous consensus mechanisms are Proof of Work (PoW) and Proof of Stake (PoS).

The greatest blockchain achievement

One of the greatest achievements of decentralized blockchains is the fact that actors who have never known each other before work together towards a common goal. As you might guess, this goal is to keep the blockchain running.

If you’re wondering, how did they achieve such a complicated goal? The answer is as simple as it is complex. Incentives. By aligning the right incentives, blockchains get unknown actors to collaborate with each other.

Now that we know what this type of system is all about, let’s take a look at its advantages and, of course, its disadvantages.

Advantages of decentralization

Cypherpunks reading this article will be very happy. After reviewing the disadvantages of centralization, it is time to analyze the advantages of decentralization.

Censorship resistance

Decentralized networks are designed to be censorship-resistant, meaning that no single entity can prevent transactions from taking place, or change or manipulate the ledger without the consensus of the network.

Transparency

Undoubtedly, since the birth of Bitcoin, one of the most important points of decentralized networks. The decentralized nature of a cryptocurrency blockchain facilitates transparency. In them, all transactions and the current state of the ledger are visible to all members of the network. There is nothing to hide in a blockchain.

Security

Decentralization makes these networks more secure. In this type of system, power and control are distributed among a large number of actors, rather than relying on a single point of failure. This eliminates the risk of a single entity compromising the network.

Robustness

Another important feature of decentralization is that it makes the network more robust and resistant to attacks. Again, by eliminating the single point of failure that can bring down the entire system, the decentralized networks are more secure.

Community control

Users take back power. Thanks to decentralization, these networks have an equitable distribution of power, as control of the network is distributed among the participants. Evidently, with this power, there will be greater community participation and commitment, since people have a real interest in the network.

Innovation

Decentralization invites innovation. By allowing more people to participate and contribute to the development of the network, users will be encouraged to innovate the network, as they will feel it as their own.

Financial inclusion

Undoubtedly, a standard-bearer in the crypto world. Decentralization fosters financial inclusion. Users can participate in the network and access their financial services without the need for intermediaries or permissions from centralized authorities.

It should be noted that there is no one-size-fits-all approach to decentralization. Moreover, as mentioned above, full decentralization, at least to date, does not exist. The appropriate level of decentralization will depend on the specific use case and network requirements.

Now, let’s see the negative side of decentralization.

Disadvantages of decentralization

Now, it is time to analyze the other side of the coin. Obviously, the decentralized world is not a paradise where everything goes smoothly. Therefore, let’s look at the disadvantages that these systems face.

Scalability

If you find yourself in the crypto world, there’s no way you haven’t heard of this problem. Decentralized networks can be more difficult to scale than centralized ones. For example, the Bitcoin blockchain can currently process about 7 transactions per second, while a centralized payment system such as Visa can handle thousands per second. This can result in slower transaction times and higher fees for users.

Lack of regulation

The lack of regulation is contradictory. While some see it as a positive point, others consider it a negative feature of the decentralized world. Because decentralized networks are not controlled by a single entity, they may not be subject to the same regulations as traditional financial institutions. This can make it easier for illegal activities such as money laundering and fraud to occur on the network.

Lack of oversight

The fear of users who have not yet joined crypto often starts here. Decentralization also means that there is no entity that can be held accountable for problems that arise on the network. This can make it difficult, or even impossible, to resolve problems such as hacking and fraud.

Technical Complexity

Undoubtedly, a major setback that the crypto world has faced since the birth of Bitcoin. The technology behind decentralized networks and cryptocurrencies is complex. Understanding it requires a certain level of knowledge and technical skills. The hours of study required may exclude some people from using and participating in it.

It is important to note that these are potential drawbacks, and not all decentralized networks or cryptocurrencies will necessarily suffer from these problems. Furthermore, the cryptocurrency community is actively working on many of these issues and solutions may be developed in the future.

Centralization and decentralization, two opposing models that when brought together create a new hybrid system, CeDeFi.

CeDeFi and hybrid models

CeDeFi is the acronym for “Centralized-Decentralized finance”. As weird as it looks after seeing it for the first time, it would get more sense after a short explanation. It is the term that has been used to describe a new trend in the decentralized finance, DeFi, ecosystem. The idea behind CeDeFi is to combine:

- The best aspects of both centralized and decentralized finance

By combining these, different but related, worlds it’s possible to

- Offer the benefits of DeFi, such as accessibility, transparency, and permissionless access

- While also providing some of the benefits of centralized finance, like stronger security and regulatory compliance

In fact, CeDeFi projects often involve building DeFi platforms on top of existing centralized infrastructure. A great example of a CeDeFi platform is one that might use smart contracts on a public blockchain to facilitate decentralized lending and borrowing, but use a centralized custodian to hold the assets used as collateral.

Crypto world’s acceptance of CeDeFi solutions

Lately, CeDeFi has been drawing the attention of many in the crypto ecosystem as a way to overcome some of the limitations of traditional DeFi platforms, such as low liquidity and scalability issues. It’s also expected that CeDeFi will be able to be more compliant with regulatory requirements.

Another aspect that is worth mentioning is security. There are those who consider it safer than DeFi because they work with smart contracts but also centralized companies with their legal structure and insurance backup. It is necessary to recognize that for those taking their first steps, it can be a good place to gain confidence and begin to understand how the tools of the ecosystem work.

However, for the purists of the crypto world, those cypher punks still value decentralization, and CeDeFi is not an option. They see it as another attempt by the traditional financial world to curtail the freedom provided by cryptocurrencies and blockchain technology.

The important fact is that there are options for everyone.

Conclusion

By reading this article, it is possible to conclude that there is no best or worst model. Centralization, decentralization, and even hybrid models have their advantages and disadvantages and can be useful in different situations.

It’s important, especially for those of us in this ecosystem, that we don’t try to decentralize everything we deal with. At first, it may be tempting. The advantages of decentralization in the crypto world are readily apparent and can lead us to try to bring them to every area in which we find ourselves.

However, it is necessary to keep a cool head and analyze each case separately. Decentralization, or rather its implementation, implies costs that, in certain activities, would bear no relation to the benefits provided. Therefore, let us apply to each problem the solution that best suits it.